Why Submitting an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Why Submitting an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Blog Article

Simplify Your Finances: Exactly How to Submit Your Online Income Tax Return in Australia

If approached carefully,Filing your on the internet tax obligation return in Australia need not be a daunting task. Recognizing the intricacies of the tax system and effectively preparing your documents are vital very first steps. Choosing a trusted online system can streamline the process, however several overlook essential details that can impact their general experience. This conversation will certainly discover the essential components and techniques for simplifying your financial resources, eventually causing an extra reliable declaring procedure. What are the usual pitfalls to avoid, and how can you guarantee that your return is compliant and accurate?

Understanding the Tax Obligation System

To navigate the Australian tax system effectively, it is necessary to grasp its fundamental concepts and framework. The Australian tax system operates a self-assessment basis, meaning taxpayers are liable for properly reporting their earnings and determining their tax responsibilities. The main tax authority, the Australian Taxes Office (ATO), oversees conformity and imposes tax obligation regulations.

The tax system consists of various elements, including revenue tax, services and goods tax obligation (GST), and funding gains tax obligation (CGT), amongst others. Individual revenue tax is progressive, with prices enhancing as revenue increases, while corporate tax obligation rates vary for big and tiny services. Additionally, tax obligation offsets and deductions are readily available to decrease taxed income, enabling more customized tax responsibilities based on individual circumstances.

Knowledge tax obligation residency is likewise critical, as it figures out an individual's tax commitments. Locals are strained on their worldwide revenue, while non-residents are only exhausted on Australian-sourced revenue. Familiarity with these concepts will certainly empower taxpayers to make educated decisions, making sure conformity and potentially enhancing their tax obligation outcomes as they prepare to file their on-line income tax return.

Preparing Your Papers

Collecting the necessary files is a crucial step in preparing to file your on the internet income tax return in Australia. Proper documentation not only enhances the declaring procedure however likewise makes certain precision, lessening the risk of errors that might lead to charges or hold-ups.

Start by collecting your earnings declarations, such as your PAYG settlement recaps from companies, which information your revenues and tax obligation withheld. online tax return in Australia. Ensure you have your company earnings records and any type of pertinent billings if you are freelance. Furthermore, collect bank statements and documentation for any interest earned

Following, assemble documents of insurance deductible costs. This may include invoices for occupational expenditures, such as attires, travel, and tools, as well as any kind of instructional costs associated to your profession. Guarantee you have documentation for rental income and linked costs like repairs or property monitoring charges. if you own building.

Don't forget to consist of other pertinent files, such as your medical insurance details, superannuation payments, and any financial investment income declarations. By carefully arranging these papers, you establish a solid structure for a smooth and effective on-line tax return procedure.

Selecting an Online Platform

After arranging your documentation, the following step entails selecting an ideal online platform for submitting your tax return. online tax return in Australia. In Australia, numerous respectable platforms website link are offered, each offering unique functions customized to different taxpayer demands

When choosing an on the internet system, think about the interface and ease of navigating. An uncomplicated design can dramatically enhance your experience, making it much easier to input your details accurately. Furthermore, ensure the platform is compliant with the Australian Taxes Workplace (ATO) regulations, as this will assure that your entry meets all legal demands.

An additional crucial aspect is the schedule of consumer assistance. Platforms providing online talk, phone support, or detailed Frequently asked questions can provide important help if you come across obstacles throughout the declaring procedure. Furthermore, evaluate the safety procedures in area to shield your individual details. Search for platforms that utilize encryption and have a solid privacy plan.

Lastly, consider the expenses connected with different platforms. While some might supply cost-free solutions for fundamental tax returns, others might bill fees for advanced functions or extra support. Consider these aspects to choose the platform that straightens finest with your financial scenario and declaring needs.

Step-by-Step Declaring Procedure

The step-by-step filing procedure for your on the internet tax return in Australia is made to enhance the submission of your economic info while guaranteeing conformity with ATO guidelines. Begin by collecting all required records, including your earnings statements, financial institution statements, and any kind of receipts for reductions.

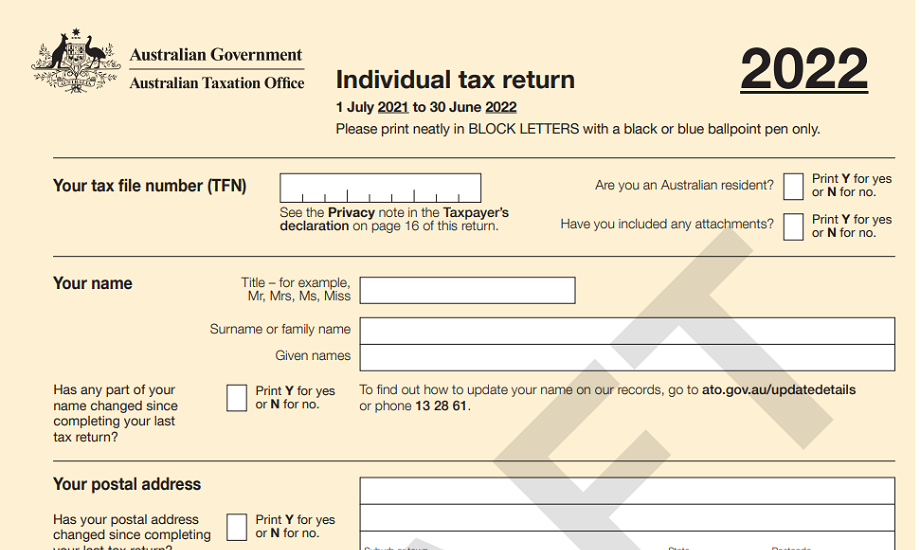

Once you have your records prepared, visit to your selected online system and create or access your account. Input your individual details, including your Tax obligation File Number (TFN) and call information. Following, enter your income information accurately, making sure to include all income sources such as incomes, rental revenue, or investment incomes.

After detailing your earnings, proceed to claim qualified reductions. This may consist of occupational costs, philanthropic donations, and clinical expenses. Make sure to assess the ATO guidelines to maximize your cases.

When all details is entered, carefully assess your return for precision, correcting any kind of discrepancies. After making certain everything is right, send your tax obligation return electronically. You will receive a confirmation of entry; maintain this for your documents. read here Monitor your account for any type of updates from the ATO regarding your tax obligation return condition.

Tips for a Smooth Experience

Finishing your on the internet tax obligation return can be an uncomplicated procedure with the right prep work and frame of mind. To guarantee a smooth experience, begin by gathering all required files, such as your earnings statements, receipts for deductions, and any various other pertinent economic documents. This organization lessens mistakes and conserves time during the filing procedure.

Following, acquaint yourself with the Australian Taxation Workplace (ATO) site and its online solutions. Use the ATO's resources, consisting of overviews and FAQs, to clarify any kind of uncertainties before you begin. online tax return in Australia. Think about establishing a MyGov account connected next page to the ATO for a streamlined declaring experience

Additionally, benefit from the pre-fill performance offered by the ATO, which instantly occupies several of your info, decreasing the opportunity of errors. Guarantee you confirm all access for accuracy prior to submission.

If issues emerge, don't be reluctant to seek advice from a tax obligation professional or utilize the ATO's support solutions. Adhering to these tips can lead to a convenient and effective online tax return experience.

Conclusion

In final thought, submitting an on-line tax obligation return in Australia can be structured via careful preparation and selection of suitable resources. By comprehending the tax system, organizing needed papers, and picking a certified online system, people can browse the declaring process successfully. Complying with an organized technique and using offered support guarantees accuracy and maximizes eligible deductions. Inevitably, these techniques add to an extra effective tax filing experience, simplifying economic monitoring and boosting compliance with tax commitments.

Report this page